Last year 83,703 Canadians filed consumer proposals and avoided bankruptcy.

We can help.

We analyzed 450,000+ Canadians in critical debt and can help find the best solution for you, including

Knowing your rights when it comes to debt, including wage garnishment, debt collection and harassing phone calls

Understanding your debt reduction options, specializing in government debt reduction programs and assistance

If insolvency is your best option, recommending which Trustee will provide the best offer and service

Get a FREE 20 minute phone debt counselling session

We take privacy seriously and we don't like spam either.

Who we are

We are a network of specialist in the insolvency industry ranging from data analysts, lenders, Licensed Insolvency Trustees, and financial advisors.Collectively, we are experts in helping Canadian consumers in critical debt.

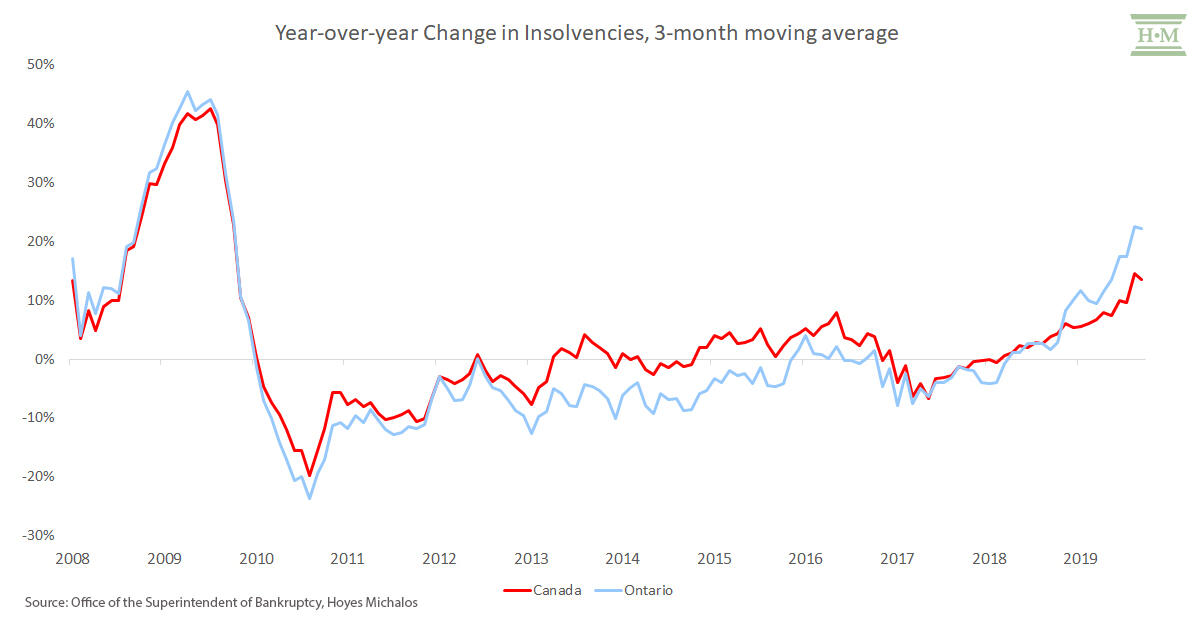

Increasing Insolvencies

Since April 2018, the number of insolvency filings in Canada, and the rate of growth, is accelerating. Canadian insolvencies went up almost 10% in 2019, while Ontario and other provinces will be above 16%.

You're not alone

Canadians have never been more in need than they are right now. There are too many Canadians in debt.Debt was at an all time high, and was accelerating. Now there is a financial crisis and Canadians are losing their jobs due to the global COVID-19 pandemic.We need to do more to protect Canadian in critical debt.

How we help

Debt Options

Understanding your debt options when it comes to government debt reduction programs and assistance

Government Programs

If eligible for government debt programs, recommending which Trustee will provide the best offer and service

Know your Rights

Knowing your your rights when it comes to debt including debt collection and wage garnishment

Testimonials

“I wish I would have reached out to them sooner. You do you research, you get as much information as you can, but you still don’t know what you don’t know. They saved me thousands of dollars by sharing the best way to file for bankruptcy. They are right – companies go strategically bankrupt every day, why shouldn’t we!”

Nancy, Calgary, Alberta

Very knowledgeable and super friendly!

If you’re struggling with your finances, don’t hide from them. It feels embarrassing when you can’t seem to grasp your money coming in vs. going out. Olivia has helped me immensely, with her professional approach and deep understanding on the matter, while I’ve been restoring my credit. I would recommend her to anyone and everyone who has been on the path of financial struggle!

Beckie, Edmonton, Alberta

You're not alone. Get help now.

We can help. Provide a few details and let us know how to reach you and we'll have a trained financial advisor contact you within 24 hours for FREE.

We take privacy seriously and we don't like spam either.

We are now part of the Debt Insiders family. Please go to https://www.DebtInsiders.ca

Made with <3 in Canada

© Free Debt Counselling. All rights reserved.

Thank you!

A professional debt advisor will contact you within 24 hours for a FREE counselling session. That's right, no obligation and no cost.